Understanding How EXIM Bank Powers U.S. Global Trade Efforts

Ever wonder how small businesses in the U.S. can continue to compete successfully in fiercely competitive international markets? The answer often lies in a vital yet understated institution—the Export-Import Bank of the United States (EXIM Bank). Established in 1934 as a stimulus during the Great Depression, EXIM Bank has contributed significantly to the facilitation of U.S. exports through financing businesses of all sizes. From providing loans and guarantees to securing payment for exporters, such a government-backed institution bridges gaps in private sector financing, fostering the American goods and services that thrive around the world.

Beyond the realm of economics, EXIM Bank is a means to an end: encouraging opportunity and innovation while working to ensure fair competition for U.S. businesses in an increasingly complex global sphere. Let's dig deeper into the history, function, and impact of this critical institution.

A Brief History of the Export-Import Bank of the United States

Born in the necessary sands of the Great Depression, the Export-Import Bank of the United States aimed to boost American exports and bring down unemployment by financing overseas buyers of U.S. goods. The Bank has evolved over the decades, determining its policies and priorities as the global economy continues to change.

The EXIM Bank primarily engaged in large-scale industrial exports while supporting major exports such as aircraft sales and infrastructure development abroad. However, the bank has since concentrated on small and medium enterprises (SMEs), following a direction that depicts their ever-growing trend in the U.S. economy. It addresses those financing gaps that private lenders may shy away from, making it a lifeline for companies that want to expand their global business but lack sufficient resources to manage the risks of international trade.

Despite its success, EXIM Bank has also undergone times of political scrutiny by those who question the relevance of the institution in free-market policies. However, the bank's record of supporting U.S. jobs and advancing economic growth has kept it firmly at the forefront of America's export strategy.

How EXIM Bank Supports U.S. Businesses

At its core, EXIM Bank provides financial solutions that private lenders often cannot or will not offer due to the high risks associated with international transactions. Its primary tools include:

Loan Guarantees

EXIM Bank guarantees loans made by commercial lenders to foreign buyers of U.S. goods. These guarantees mitigate risks for lenders, ensuring that businesses have access to credit without fear of default. For instance, an American manufacturer exporting industrial machinery to a developing country might struggle to secure financing from a private lender. EXIM’s loan guarantees step in to make such transactions feasible, reducing risk for all parties involved.

Direct Loans

In cases where private lenders are unable or unwilling to finance transactions, EXIM Bank provides direct loans to foreign buyers of U.S. products. These loans are competitive with international financing options, ensuring U.S. exporters are not at a disadvantage. For example, when large infrastructure projects, such as renewable energy installations or telecommunications systems, require financing, EXIM’s direct loans allow U.S. businesses to win contracts that might otherwise go to foreign competitors.

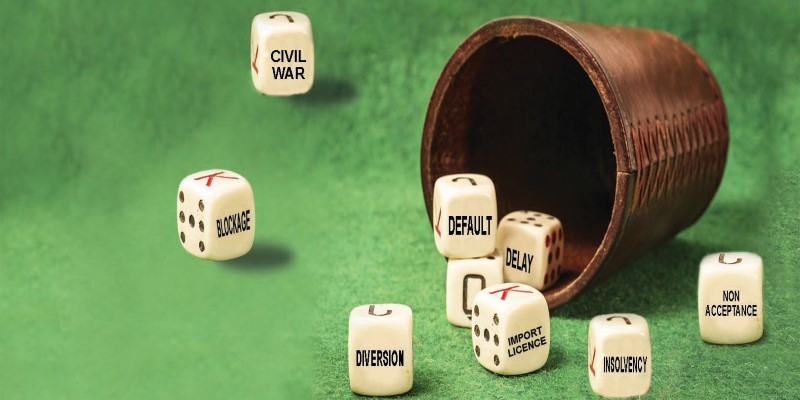

Export Credit Insurance

EXIM’s export credit insurance is a game-changer for businesses worried about nonpayment risks. It shields exporters against losses caused by buyer insolvency or political instability in the importing country. This protection is especially valuable for small businesses exploring new and potentially risky markets. For instance, a U.S.-based small business exporting specialty foods to South America could expand confidently, knowing that EXIM's insurance covers any payment defaults.

Working Capital Support

EXIM Bank offers working capital guarantees to help businesses secure the funds needed to produce goods for export. This is particularly beneficial for small and medium-sized enterprises (SMEs), which may struggle with cash flow when fulfilling large international orders. For example, a small manufacturer producing components for a foreign automotive company can use EXIM’s working capital program to ensure timely production and delivery without financial strain.

Focus on Small Businesses

In recent years, EXIM Bank has strengthened its focus on small businesses, which make up the backbone of the U.S. economy. Dedicated programs and outreach initiatives aim to make the Bank’s services more accessible to SMEs. By simplifying application processes and offering tailored support, EXIM ensures that smaller enterprises can compete in global markets just like their larger counterparts.

The Economic Impact of EXIM Bank

EXIM Bank’s influence extends far beyond individual businesses—it’s a catalyst for broader economic growth. By supporting exports, the Bank directly contributes to job creation and retention in the U.S. According to recent estimates, every billion dollars in EXIM-backed exports supports tens of thousands of American jobs.

Additionally, EXIM Bank plays a strategic role in countering unfair trade practices. Many foreign governments heavily subsidize their industries, giving their exporters an unfair edge in global markets. EXIM Bank’s financing solutions help U.S. businesses remain competitive by offsetting these advantages.

Beyond its economic contributions, the Bank promotes innovation by encouraging businesses to develop and export cutting-edge technologies. From renewable energy projects to advanced manufacturing equipment, EXIM Bank facilitates the global spread of American ingenuity.

Challenges and Controversies

Despite its successes, EXIM Bank has not been without controversy. Critics argue that its activities amount to government interference in the free market, with some describing it as "corporate welfare" for large businesses. While EXIM Bank’s supporters emphasize its role in supporting SMEs, a significant portion of its financing historically went to major corporations like Boeing and General Electric.

Political debates have also threatened the Bank’s operations. In 2015, EXIM Bank faced a temporary shutdown when Congress failed to renew its charter. Although the Bank eventually resumed operations, the episode highlighted the fragility of its political support.

Conclusion

The Export-Import Bank of the United States serves as a vital link between American businesses and the global market. Bridging financing gaps empowers companies to compete internationally, fostering economic growth and job creation at home. Despite challenges and occasional criticism, EXIM Bank's role in leveling the playing field for U.S. exporters remains essential. In an increasingly competitive global economy, its mission to support American businesses ensures that U.S. innovation and expertise can thrive on the international stage. For many exporters, EXIM Bank is the key to unlocking global opportunities.